Navigating the World of Investments: A Comprehensive Guide

Contributing is an excursion that can prompt monetary development, security, and the accomplishment of long haul objectives. Notwithstanding, an excursion requires cautious preparation, informed choices, and a comprehension of the different scene of venture choices. We should set out on this investigation of the universe of ventures, covering essential ideas, normal resource classes, risk the board procedures, and the significance of an obvious speculation system.

Figuring out Venture Fundamentals

Speculation Characterized:

Definition: Speculation includes distributing assets with the assumption for creating a return or benefit after some time.

Objective: To develop abundance, safeguard capital, produce pay, or accomplish explicit monetary objectives.

Hazard and Return:

Risk-Award Relationship: By and large, higher potential returns are related with more elevated levels of hazard.

Expansion: Spreading speculations across various resource classes oversees risk.

Time Skyline:

Long haul versus Present moment: The time period for which you intend to hold your speculations impacts the selection of resources and chance resilience.

Compounding:

Force of Compounding: Income from ventures produce unexpected returns, intensifying over the long haul.

Significance of Early Financial planning: Beginning early permits additional opportunity for compounding to help you out.

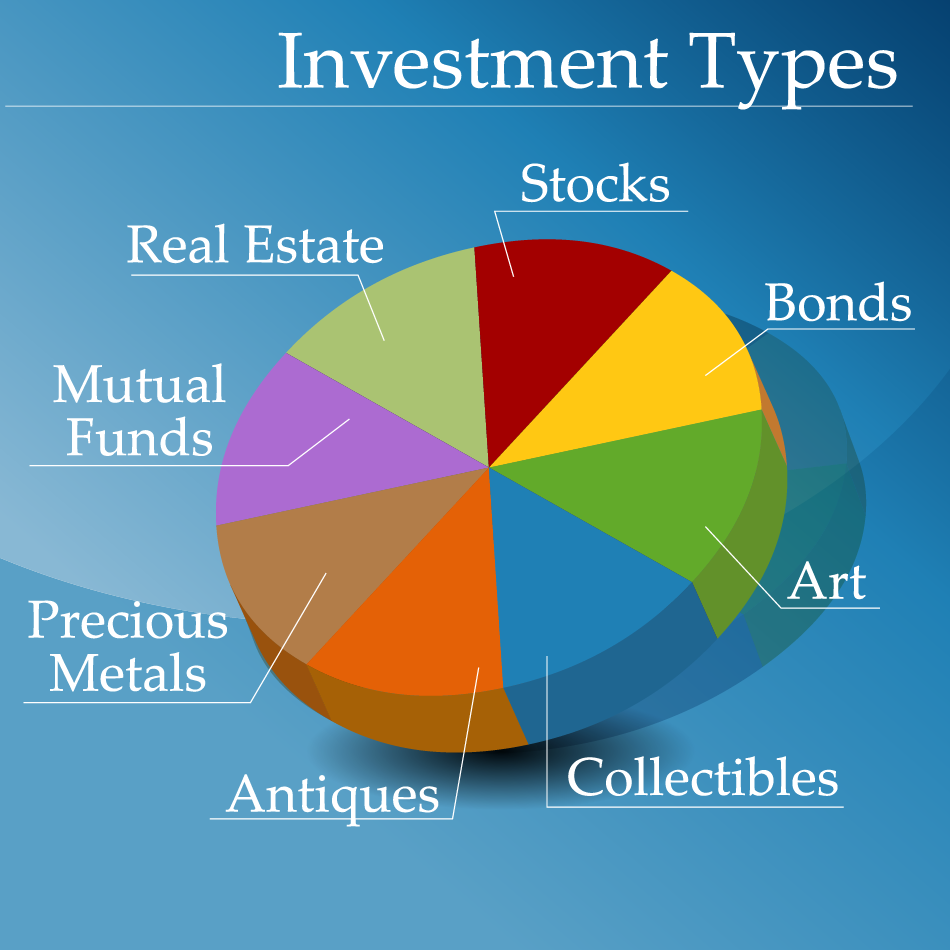

Normal Resource Classes

Stocks (Values):

Proprietorship in Organizations: Stocks address possession in an organization and qualifies investors for a piece of benefits.

Chance and Return: Stocks can offer exceptional yields however accompany higher unpredictability.

Bonds (Fixed-Pay):

Obligation Protections: Securities are obligation instruments where financial backers loan cash to guarantors in return for occasional premium installments and return of head.

Hazard and Return: By and large lower risk than stocks, with returns basically from interest installments.

Shared Assets:

Pooled Ventures: Shared reserves pool cash from various financial backers to put resources into an enhanced arrangement of stocks, bonds, or different protections.

Proficient Administration: Asset chiefs pursue speculation choices for financial backers.

Land:

Actual Properties: Putting resources into actual properties for rental pay or capital appreciation.

REITs: Land Venture Trusts permit financial backers to get to land without direct proprietorship.

Trade Exchanged Assets (ETFs):

Exchanged on Trades: ETFs are venture supports that exchange on stock trades, following a record or a product.

Enhancement and Liquidity: ETFs offer expansion and the adaptability of stock exchanging.

Digital forms of money:

Computerized Resources: Cryptographic forms of money like Bitcoin and Ethereum work on decentralized blockchain innovation.

High Instability: Cryptographic forms of money can be exceptionally unstable, introducing the two valuable open doors and dangers.

Developing a Differentiated Portfolio

Resource Assignment:

Adjusting Chance and Return: Assigning finances across various resource classes in light of hazard resilience, objectives, and time skyline.

Rebalancing: Occasionally changing the portfolio to keep up with the ideal resource distribution.

Expansion:

Diminishing Gamble: Spreading speculations across various resources mitigates the effect of horrible showing in any one venture.

Resource Class Broadening: Expanding among stocks, bonds, land, and different resources.

Risk The board Techniques

Risk Resilience:

Grasping Gamble: Evaluating one's solace level with the chance of speculation misfortunes.

Adjusting Ventures: Picking speculations that match risk resilience and monetary objectives.

Backup stash:

Monetary Pad: Having a backup stash in a fluid and open structure to cover unforeseen costs.

Risk Relief: A secret stash gives a cradle, lessening the need to sell ventures during monetary difficulties.

Protection:

Defensive Measures: Satisfactory protection inclusion for wellbeing, life, property, and different resources.

Risk Move: Protection moves specific dangers from the person to the protection supplier.

Speculation Techniques

Aloof versus Dynamic Financial planning:

Uninvolved: Record assets and ETFs mean to duplicate the exhibition of a particular market list.

Dynamic: Dynamic financial backers expect to beat the market through exploration and dynamic independent direction.

Mitigating risk:

Steady Financial planning: Contributing a proper sum consistently, paying little heed to showcase variances.

Risk Relief: Mitigating risk diminishes the effect of market instability on by and large venture costs.

Esteem Financial planning:

Major Examination: Distinguishing underestimated stocks in view of an investigation of their characteristic worth.

Long haul Approach: Worth financial backers center around the drawn out capability of their ventures.

Development Contributing:

Accentuation on Development: Putting resources into organizations with high development potential.

Chance and Return: Development contributing frequently accompanies higher unpredictability however the potential for critical returns.

Checking and Reconsidering

Ordinary Survey:

Intermittent Appraisal: Consistently survey the exhibition of the portfolio and make changes depending on the situation.

Adjusting to Life Changes: Changes in monetary objectives, risk resilience, or life conditions might warrant changes.

Remaining Informed:

Financial and Market Patterns: Remain informed about monetary pointers, market patterns, and worldwide occasions.

Persistent Picking up: Continuous schooling about ventures and monetary business sectors improves independent direction.

End: Creating Your Venture Process

Contributing is a dynamic and developing cycle, impacted by private objectives, risk resistance, and the steadily changing scene of monetary business sectors. As you leave on your venture process, it's crucial for approach it with an unmistakable comprehension of your targets, a differentiated and even portfolio, and the adaptability to adjust to evolving conditions. Whether you're a carefully prepared financial backer or simply starting to investigate the potential outcomes, the universe of speculations offers a range of chances for those able to explore it with industriousness, information, and an essential mentality.